NATIONAL FUEL GAS (NFG)·Q1 2026 Earnings Summary

National Fuel Gas Beats EPS by 7% on Surging Utica Production

January 29, 2026 · by Fintool AI Agent

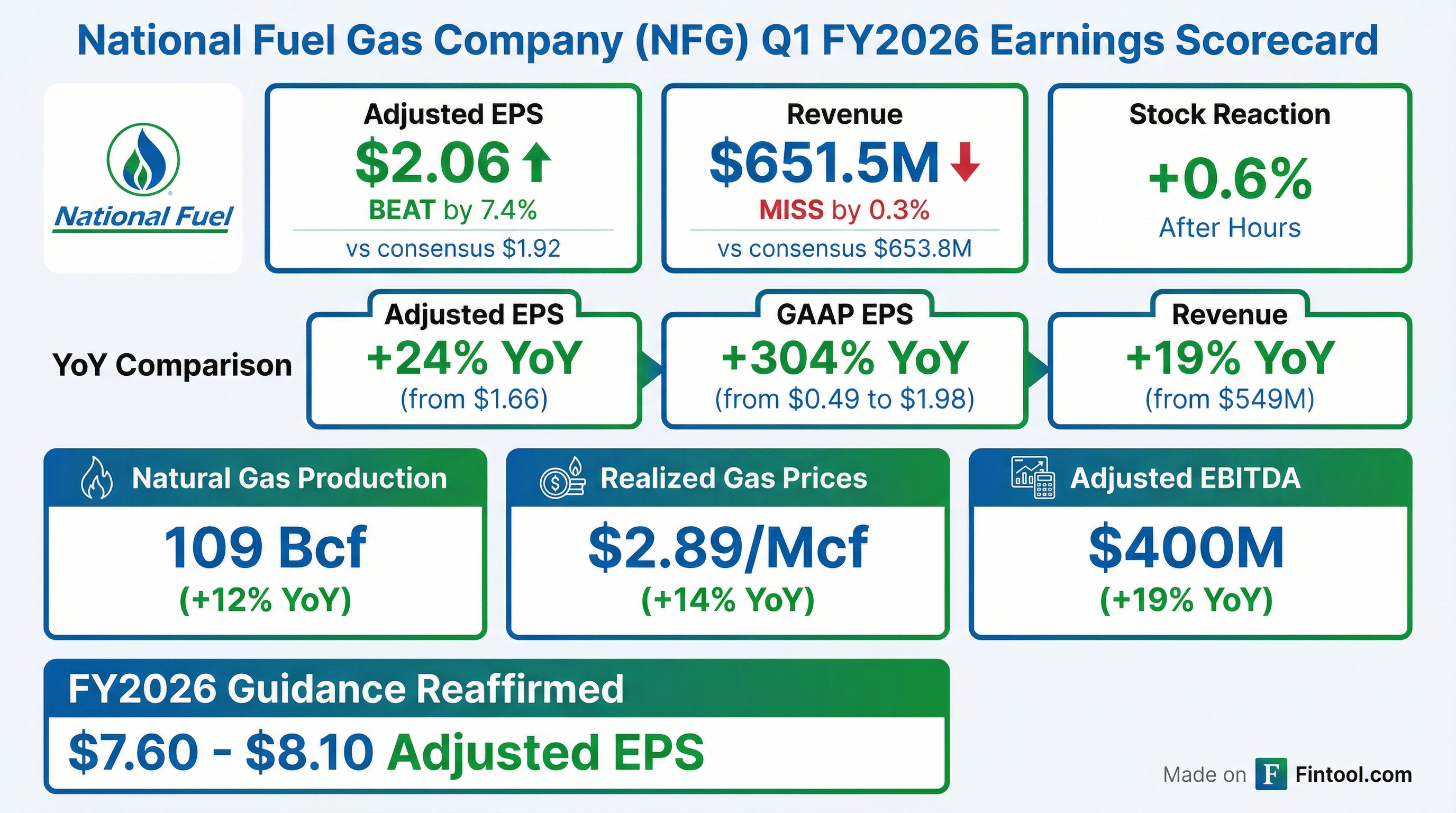

National Fuel Gas Company (NYSE: NFG) delivered a strong start to fiscal 2026, beating adjusted EPS estimates by 7.4% as surging Utica production and higher natural gas prices drove a 24% increase in adjusted earnings year-over-year . The integrated energy company reaffirmed full-year guidance and noted key infrastructure projects remain on track for late calendar 2026 .

Did National Fuel Gas Beat Earnings?

Yes — NFG beat on EPS but narrowly missed on revenue.

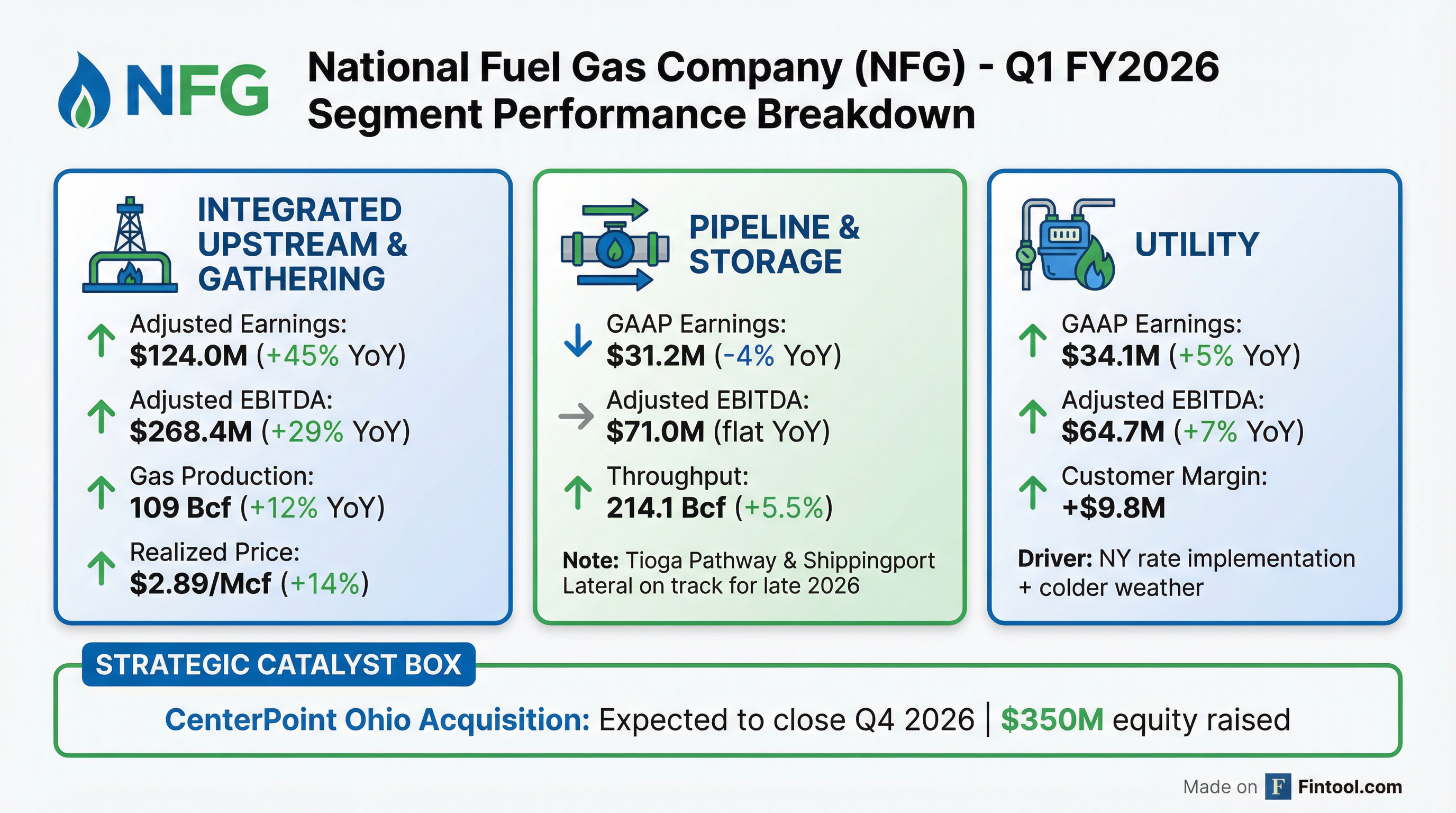

The EPS beat was driven by exceptional performance in the Integrated Upstream and Gathering segment, where adjusted EPS contribution jumped 45% to $1.36 compared to $0.94 in the prior year .

Year-over-year comparison:

The dramatic YoY improvement in GAAP earnings reflects the absence of $104.6 million in after-tax impairment charges recorded in Q1 FY25 .

What Drove the Beat?

Production Growth from Utica Wells

Natural gas production reached 109 Bcf, up 12% from 98 Bcf in the prior year . The increase came from new Utica pads turned in line in Tioga County, Pennsylvania.

Higher Realized Prices

Seneca's weighted average realized natural gas price increased 14% to $2.89 per Mcf after hedging and transportation costs, up from $2.53 in Q1 FY25 . This was driven by:

- Higher NYMEX prices

- Realized gains on natural gas hedges

- Better prices at local Pennsylvania sales points

Segment Performance

The Utility segment benefited from $9.8 million in higher customer margin, driven by implementation of year two of New York's three-year rate agreement and colder weather .

What Did Management Guide?

NFG reaffirmed FY2026 adjusted EPS guidance of $7.60 to $8.10, with a midpoint of $7.85 .

Key guidance assumptions for the remaining nine months:

Commodity price sensitivity:

The CenterPoint Ohio acquisition is not included in FY2026 guidance, as it's expected to close in Q4 calendar 2026 .

Key Strategic Updates

CenterPoint Ohio Acquisition

NFG successfully issued $350 million in common equity through a private placement to fund the pending acquisition of CenterPoint Energy's Ohio natural gas utility . The transaction is expected to close in Q4 calendar 2026.

Infrastructure Projects on Track

Two major pipeline projects remain on schedule for late calendar 2026 in-service :

- Shippingport Lateral Project — Received FERC authorization in November 2025

- Tioga Pathway Project — Previously approved, construction progressing

Utica Development Inventory

Management highlighted the addition of approximately 200 prospective Upper Utica drilling locations, expanding the company's high-quality Appalachian development inventory . The company now has over 400 Utica locations between uppers and lowers .

Rate Case Activity

Pennsylvania Utility: Filed a new rate case requesting approximately $20 million increase in rates, which would raise customer bills by about 11% — below the rate of inflation over the past three years .

Supply Corporation: Expects to file a rate case later this fiscal year to recover costs related to the modernization program and general expense inflation .

Production Cadence for FY2026

- Q2 volumes expected slightly down from Q1 due to drill timing and deferring activity during winter storm

- Q3 production expected to increase and hold steady through fiscal year-end

- Large Tioga Utica pads coming online in Q3/Q4

How Did the Stock React?

NFG shares traded up +2.9% on the day following the earnings release, closing at $84.08 on January 29. The stock is now trading near the middle of its 52-week range ($68.65-$94.13).

Beat/miss track record (last 8 quarters):

NFG has beaten EPS estimates in 7 of the last 8 quarters.

What Did Management Say?

CEO Dave Bauer on the natural gas industry outlook:

"The outlook for natural gas is as strong as it's ever been, with demand at all-time highs. On top of that, there's a growing need for LNG feed gas and new baseload power generation, most of which will be produced using natural gas."

On policy shifts:

"We've long advocated that an all-of-the-above approach to energy is the most effective way to both reduce emissions and maintain the affordability and reliability of energy supplies. I'm encouraged to see policymakers begin to move in that direction."

CFO Tim Silverstein on fiscal 2027 outlook:

"Fiscal 2026 adjusted EPS is projected to grow 14% over last year, and the setup for 2027 is for even more growth across the organization."

On the company's competitive position:

"It's an exciting time to be in the natural gas industry. National Fuel has a unique set of integrated assets in the most prolific gas region of the country. Add to that a strong investment-grade balance sheet, and we are very well positioned to help develop the resource and build the infrastructure needed to serve the growing demand for natural gas."

Operating Costs Under Control

The $0.04/Mcf increase in lease operating expense was primarily due to higher third-party gathering expenses from a six-well pad on acreage dedicated to another midstream operator, plus higher workover and maintenance costs .

Balance Sheet & Cash Flow

The significant increase in cash position reflects the $350 million equity raise in preparation for the Ohio acquisition .

Q&A Highlights: What Analysts Asked

Historic Natural Gas Price Volatility

CFO Tim Silverstein highlighted unprecedented price swings:

"Yesterday, the February contract settled at almost $7.50, a 140% increase from just two weeks ago. This was a record move in the 35-year history of a NYMEX natural gas contract."

Management expects this volatility to persist:

"We believe this kind of price fluctuation is the new normal and will persist in the coming years. Strong structural demand from LNG exports and power generation, combined with limited new storage and pipeline infrastructure, supports a price environment in the $3-$5 range, with potential for weather-driven deviations lasting weeks or months."

NFG's hedge book provides downside protection while preserving upside:

- 70% of remaining FY26 production hedged

- ~80 Bcf of collars with $3.60 floor / $4.75 cap

- Upside exposure on 50%+ of expected remaining production

Gen 4 Well Design Testing

Justin Loweth (President, Seneca Resources) provided details on next-generation well optimization:

- First full Gen 4 pad expected online later this spring

- Key changes: wider inter-well spacing, 3,000 lbs/foot prop loading

- Incremental cost: ~$150-175/foot

- Testing higher initial rates at 40 MMcf/day vs. current 25-30 MMcf/day

Upper vs. Lower Utica Development Strategy

NFG is actively testing co-development approaches:

"We're just beginning to flow back our first full upper and lower Utica co-development pad and have more tests planned over the next 12 to 18 months."

Current development lean is toward lower Utica first due to "slightly better economic edge," but management is keeping options open pending test results .

Pipeline Expansion Opportunities

CEO Dave Bauer expressed optimism about future infrastructure growth:

"We've had continued interest in projects in and around our line and system. We tend to be pretty conservative when we announce projects, but we are in active dialogue with other parties and fully believe we'll have additional opportunities down the road."

Key pipeline updates:

- Total firm transportation capacity growing from 1 Bcf/day to 1.5 Bcf/day over next few years

- Nessie pipeline greenlit by FERC and New York — positive for NFG's Atlantic Sunrise and Leidy South capacity

- Storage is 100% contracted under stated procurable rates

Ohio Regulatory Improvements

The Ohio Commission issued its final order with minor modifications to the CenterPoint settlement:

- ROE lowered slightly to 9.79% (6 bp reduction) — ~$500K/year impact

- Amortization period extended from 15 to 25 years

More significantly, Ohio recently passed legislation modernizing rate-making:

- Rate case timeline shortened from 15-18 months to 360 days

- Three-year fully projected test year with annual true-ups to authorized ROEs

"These are nice improvements from the current approach, as they minimize regulatory lag and provide greater certainty in achieving allowed returns." — Tim Silverstein

M&A Outlook Post-CenterPoint

When asked about future M&A priorities:

"The CenterPoint deal kind of rebalances the company a bit and gives us the flexibility to look at transactions on both the regulated and non-regulated side of the business."

Sustainability Milestone

NFG announced a first-of-its-kind deal:

"We recently executed a first-of-its-kind ten-year agreement to provide 250,000 MMBTU per day of MIQ-certified methane reduction certificates to a European utility."

Key Risks to Monitor

- Natural gas price volatility — At $3.00 NYMEX, EPS guidance drops to $6.95-$7.45 ; volatility now "the new normal"

- Acquisition execution — CenterPoint Ohio deal requires regulatory approvals and integration

- Regulatory environment — Supply Corp rate case expected later this fiscal year ; Pennsylvania utility filed $20M rate increase request

- Infrastructure timing — Pipeline projects subject to permitting and construction delays

The Bottom Line

National Fuel Gas delivered a strong Q1 FY2026, with the 7% EPS beat driven by exceptional production growth from Tioga County Utica wells and favorable gas pricing. The company's integrated model — combining upstream production, midstream gathering, regulated pipelines, and utility distribution — continues to provide diversified cash flow stability.

Management's view on gas prices is notably constructive: they expect volatility to be "the new normal" with prices supported in the $3-$5 range by structural LNG and power generation demand. The hedging strategy — 70% downside protection with upside exposure on 50%+ of production — positions NFG to benefit from price spikes while limiting downside risk.

Looking ahead, the reaffirmed $7.60-$8.10 guidance and on-track infrastructure projects (Shippingport Lateral, Tioga Pathway) set the stage for continued growth. CFO Tim Silverstein noted the "setup for 2027 is for even more growth across the organization." The CenterPoint Ohio acquisition, expected in Q4 calendar 2026, will add scale to the utility segment, and management signaled flexibility to pursue both regulated and unregulated M&A post-close.

More Resources: